Languages

Government Relations - A history of CAGP Advocacy

[click here to download the infographic in full resolution]

[click here to download the infographic in full resolution]

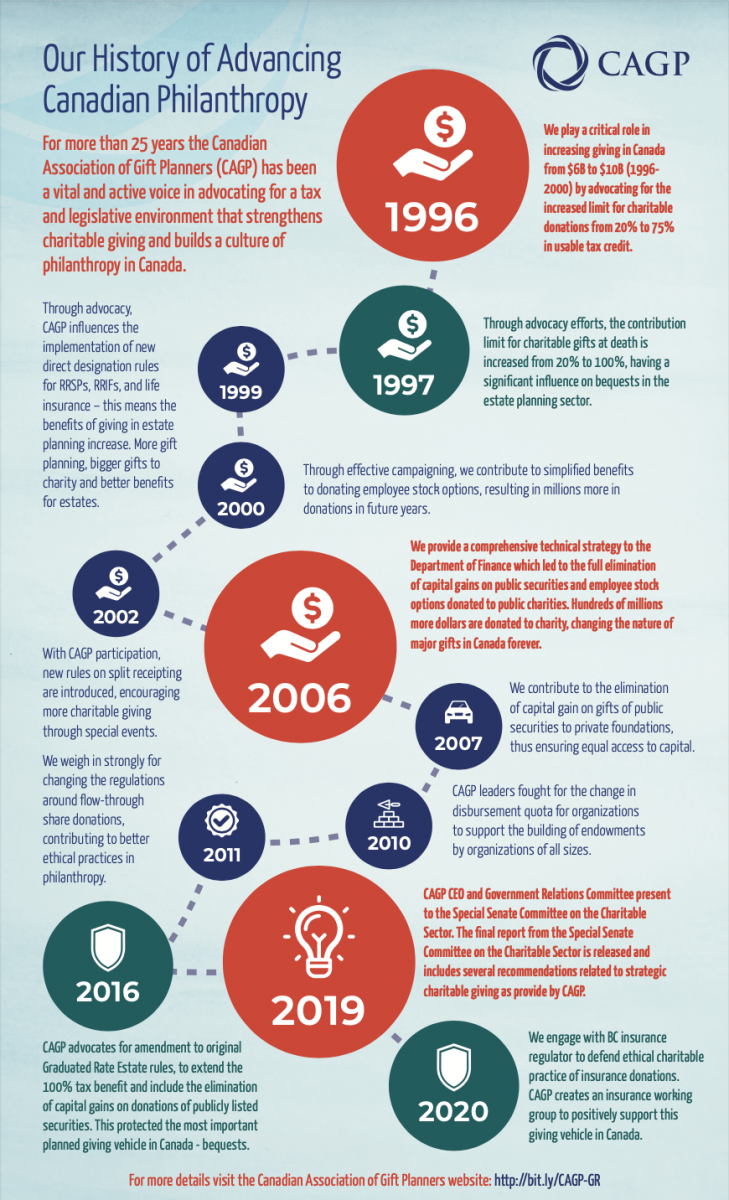

1996

CAGP plays a critical role in increasing giving in Canada from $6B to $10B (1996-2000) by advocating for the increased limit for charitable donations from 20% to 75% in usable tax credit.

1997

Through our advocacy efforts, the contribution limit for charitable gifts at death is increased from 20% to 100%, having a significant influence on bequests in the estate planning sector. Charitable giving goes from social good to  a concrete tactic for valuable estate planning. And because there is no minimum amount for this tax credit qualification on estates, this massive tax benefit becomes a highly democratizing element for charitable giving through estates - anyone can now benefit from leaving a bequest!

a concrete tactic for valuable estate planning. And because there is no minimum amount for this tax credit qualification on estates, this massive tax benefit becomes a highly democratizing element for charitable giving through estates - anyone can now benefit from leaving a bequest!

CAGP assists in drafting a definition of the rules re: Non-Qualifying Securities

CAGP works with provincial regulators on charitable annuities

1998

We work with land trust organizations to support a new eco-gift program and the elimination of capital gains on gifts of eligible property, launching a major decade of environmental gifts and greater protection of more of Canada’s natural land.

1999

Through our advocacy, CAGP influences the implementation of new direct designation rules for RRSPs, RRIFs, and life insurance – this means the benefits of giving in estate planning increase . More gift planning, bigger gifts to charity and better benefits for estates.

Through our advocacy, CAGP influences the implementation of new direct designation rules for RRSPs, RRIFs, and life insurance – this means the benefits of giving in estate planning increase . More gift planning, bigger gifts to charity and better benefits for estates.

2000

Through effective campaigning, CAGP contributes to simplified benefits to donating employee stock options, resulting in millions more in donations in future years.

This also contributed to refining the rules where cash proceeds of stock options or public traded stock is donated within 30 days.

2001

We co-lead survey and report to Department of Finance on five-year pilot project of public securities incentive – incentive is made permanent.

2002

With CAGP participation, new rules on split receipting are introduced, encouraging more charitable giving through special events.

With CAGP participation, new rules on split receipting are introduced, encouraging more charitable giving through special events.

2003

We contribute to the regulation of tax credit related to donation tax shelters, playing an active role in defining ethical best practices.

2005

We join sector allies in advocating against over-regulation in a Canada Revenue Agency proposal for ‘source of funds’ documentation of all gifts above $5000.

The Canada Revenue Agency invites us to join the Technical Issues Working Group & Charities Advisory Committee.

2006

CAGP provides a comprehensive technical strategy to the Department of Finance

which led to the full elimination of capital gains on public securities and employee stock options donated to public charities.Hundreds of millions more dollars are donated to charity, changing the nature of major gifts in Canada forever.

2007

We contribute to the elimination of capital gain on gifts of public securities to private foundations, thus ensuring equal access to capital.

We contribute to the elimination of capital gain on gifts of public securities to private foundations, thus ensuring equal access to capital.

CAGP weighs in on the introduction of excess business holding regime for private foundations, thereby allowing more fundraising opportunities for private foundations.

The Canada Revenue Agency permits donations of existing life Insurance policies for fair market value, further establishing best practices.

2008

CAGP is part of the coalition that successfully advocates against Bill C-470, proposing a salary cap charity salaries.

We contribute to Canada Revenue Agency fundraising policy, representing a strong voice in sector actions, ethics and practice.

2009

CAGP begins our long-term involvement in discussions on donations of private company shares and taxable real estate.

2010

CAGP leaders fought for a change in disbursement quota for charities to support the building of endowments by organizations of all sizes.

2011

2011

We weigh in strongly for changing the regulations around flow-through share donations, contributing to better ethical practices in philanthropy

2013

New rules on split receipting, which CAGP contributed to in 2002, are passed by the Canada Revenue Agency.

2015

We support draft legislation for elimination of capital gains on donations of cash proceeds from sale of private shares and real estate for the federal budget. This legislation was not enacted.

2016

CAGP advocates for amendment to original Graduated Rate Estate rules, to extend the 100% tax benefit and include the elimination of capital gains on donations of publicly listed securities. This protected the most important planned giving vehicle in Canada - bequests.

CAGP advocates for amendment to original Graduated Rate Estate rules, to extend the 100% tax benefit and include the elimination of capital gains on donations of publicly listed securities. This protected the most important planned giving vehicle in Canada - bequests.

We make a submission to the federal Standing Committee on Finance pre-budget consultation re: Charitable Remainder Trusts and data collection for the charitable sector.

2017

CAGP responds to proposed changes regarding tax planning using private corporations and possible consequences on charitable giving.

We make recommendations on withholding tax on charitable gifts made directly from registered funds, simplifying giving for both donors and advisors, and contributing to more efficient planning and giving.

2018

CAGP leaders called to submit to the Standing Committee on Finance federal budget consultation re: exemption of capital gains on donations of the proceeds from the sale of real estate and private shares, and withholding tax on direct gifts from registered funds. This will improve the lives of millions of Canadians who own businesses and are likely to inherit large tax bills.

CEO and Govt. Relations Committee members invited to present to the Special Senate Committee on the Charitable Sector to defend and advance strategic philanthropy in Canada.

CAGP contributes to the discussion around the recommendations from the CRA panel on political activities of charities, allowing for greater advocacy activity by Canada’s charities.

2019

CAGP CEO and Government Relations Committee, present to the Special Senate Committee on the Charitable Sector. The final report from the Special Senate Committee on the Charitable Sector is released and includes several recommendations related to strategic charitable giving as provide by CAGP.

We weigh in on proposed tax changes to further incentivize employee stock options and the potential impact on charitable giving.

2020 and beyond

We engage with the British Columbia insurance regulator to defend ethical charitable practice of insurance donations. CAGP creates an insurance working group to positively support this giving vehicle in Canada.

We engage with the British Columbia insurance regulator to defend ethical charitable practice of insurance donations. CAGP creates an insurance working group to positively support this giving vehicle in Canada.

To learn more about CAGP's Government Relations work, visit https://www.cagp-acpdp.org/en/resource/government-relations-advocacy