You likely have all heard of Donor Advised Funds (DAFs), but do you understand the legal implications of creating a DAF and how a DAF can be incorporated into a donor’s planned giving? In this session, we will work through a DAF case study following the life and death of a donor, beginning with a donor wanting to establish a DAF as a planned giving vehicle through to her death (and beyond). Of interest to charities and professional advisors alike, we will discuss issues such as:

what a DAF is, at law;

- the implications of creating a DAF both for the donor and for the charity that might otherwise have been receiving direct gifts from the donor;

- how donors and charities work with DAFs;

- what happens upon the death of a donor, among others

Bring your questions!

This session is worth one CFRE Credit & is a joint session with the Charities and Not-for-profit Law Subsection of the Canadian Bar Association - BC Branch.

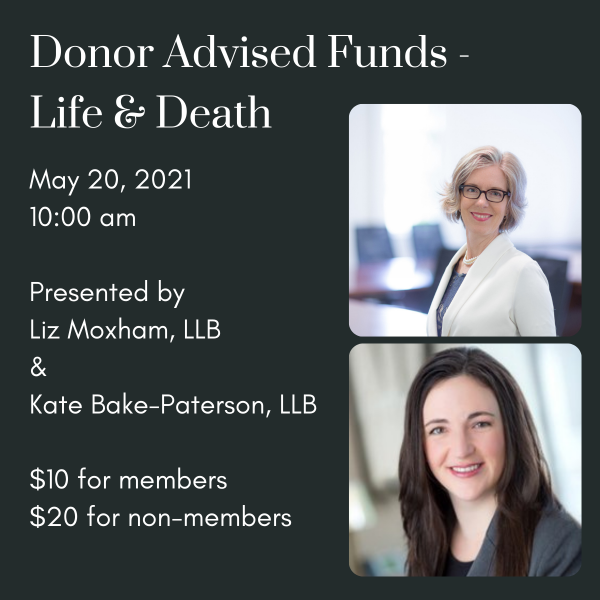

Presented by Liz Moxham, LLB and Kate Bake-Paterson, LLB

Presenters Bios

Liz Moxham is legal counsel in the Office of the University Counsel at The University of British Columbia since 2012 primarily supporting the fundraisers. She started her career at PriceWaterhouseCoopers in the tax department where she developed her interest in the charitable sector. She then worked in planned giving at BC Children’s’ Hospital Foundation for 6 years where she earned her CFRE before joining UBC. Liz is vice-chair of the National section of the Charities and Not-For-Profit Law subsection of the Canadian Bar Association; and has been a member of the CAGP since 1997, and a member of CAGP’s Government Relations Committee since 2001.

Kate Bake-Paterson is a lawyer at DLA Piper (Canada) LLP who practices in the area of charities and not-for-profit organizations. She regularly advises organizations on a broad range of issues, including governance and other matters related to incorporating and organizing not-for-profit entities; regulatory compliance (such as obtaining and maintaining charitable registration); receipt of charitable gifts and other planned giving and the conduct of social enterprise. Kate also assists donors in making charitable gifts. Kate is a member of the executive of both the Canadian Bar Association National section and BC subsection of Charities and Not-For-Profit Law.

This session is worth one CRFE Credit