Languages

Webinar: Unusual Gifts Exempt from Capital Gains

CAGP Members: Please be sure you are signed in before continuing with the registration in order to ensure you receive member pricing.

Cost: CAGP Members: $35 / Non-members: $50 (Tax exempt)

Unusual Gifts Exempt from Capital Gains

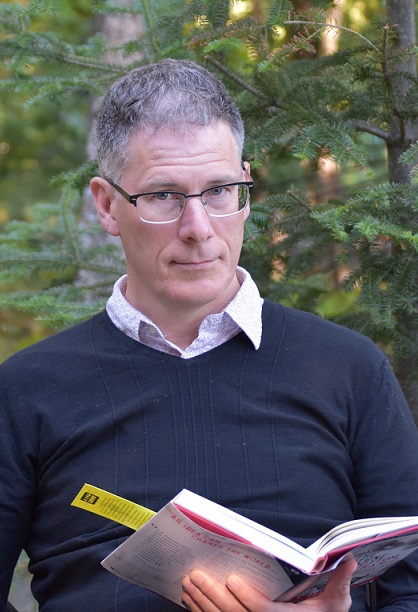

Presented by: Malcolm Burrows, Scotia Wealth Management

Description: Every gift planner knows that donations of public securities are exempt from capital gain, but there are other assets that also get this treatment that are rarely considered. Malcolm will discuss the other capital gains exempt donations such as employee stock options, restricted stock, exchangeable shares, cultural property and ecogifts. Focus will be placed on the practical issues associated with identifying opportunities and the mechanics related to these donations.

Canada

| Price | |

| Member Price | $ 35.00 + $ 0.00 Tax |

| Non-Member Price | $ 50.00 + $ 0.00 Tax |