Languages

Government Relations & Advocacy

LEARN MORE ABOUT WHAT WE HAVE ACHIEVED IN 25 YEARS

2021

Written Submission to the Department of Finance “Consultation: Boosting Charitable Spending in our Communities” [OCTOBER 2021]

CAGP respectfully submits that the current framing of the government’s policy to increase charitable spending and community investment solely through a single mechanism such as the Disbursement Quota (DQ) rate is unadvisable without due consideration of the unintended impacts that an increase to the DQ rate might have on charities’ ability to carry out their programs, on donors’ ability to continue funding charities, and on the beneficiary groups that charities will not be able to service.

2020

Charitable Gifts of Life Insurance…Building best practices for charities [JUNE 2020]

We are pleased that BCFSA has responded to our letter in a timely way, and while there may be some continued ambiguity, we feel we are in a position to proceed with leading the development of guidelines for charities in regard to promoting and accepting donations of life insurance policies, as the regulator challenged us to do. Over the coming weeks we will be convening a group of CAGP experts, as well as leaders in the insurance industry to collaborate in developing a best practices checklist which explores the relationship between donor and charity, issues that will ensure donors best interests are considered and due diligence factors for advisors.

We wanted our members to be aware of this important work that is underway, and we look forward to sharing this key leadership tool when it’s ready and to integrating this important information in our education offerings to ensure charities, donors and the insurance industry can continue to properly leverage this important strategic charitable giving tool.

CAGP Writes To The BC Regulator for Clarity on Gifts of Life Insurance [MAY 2020]

Recently, the BC Financial Services Authority released a further bulletin on “Charitable donation of Life Insurance Policies in British Columbia”. We know this issue has been of great concern to our members in British Columbia and across Canada over the past year. As part of their bulletin, the Authority has encouraged the charitable sector to both communicate current best practices for gifts of life insurance, and to develop a document on this important area of philanthropy.

After receiving many notes of concern and in consultation with our CAGP Government Relations Committee, President & CEO, Ruth Mackenzie, and board chair Michelle Osborne have written the following letter to the Authority outlining a request for further confirmation and clarification.

(Click image to read full letter)

Gifts of Life Insurance Policies [February 2020]

CAGP guidance regarding charitable gifts of life insurance

post announcement by BC Financial Services Authority

In June 2019, CAGP was made aware that a Canadian charity had received an enforcement letter from the British Columbia Financial Institutions Commission (FICOM), the insurance regulator in that province; now renamed the British Columbia Financial Services Authority (BCFSA). The charity was notified that acceptance of donations of life insurance policies is considered trafficking and is in contravention of the BC Insurance Act, and that a charity cannot solicit for life insurance policies in BC or accept any life insurance policies as donations from BC residents. In fall 2019, we were also informed that a second charity has received similar warnings from the regulator.

Discussions

The position taken by the BC Regulator is concerning because accepting donations of life insurance policies is a common and established practice for many charities in Canada. Further, while this matter pertains to the province of British Columbia, language in the equivalent statutes in other provinces is virtually identical to BC’s Insurance Act, raising a concern that this issue could emerge elsewhere in Canada.

What we know

- Over the past several months, while efforts on several fronts to gain clarity from the regulator have been made, minimal additional information has been made available. However, BCFSA has recently advised that it is undertaking a thorough review of the matter and will provide a response when it has completed its assessment and review.

- This issue pertains only to situations of the transfer of the insurance policy itself, and not situations where the donor remains the owner of policy and names the charity as a beneficiary.

- Differing views have been expressed by insurance companies about the meaning of these letters which has added to the confusion about where the line is drawn and what exactly the regulator understands is offside.

- Donors and charities are encouraged to seek legal advice when considering gifts of life insurance, other than a standard designation of a charity as a beneficiary.

CAGP Viewpoint

CAGP’s view is that life insurance policies remain an important strategic charitable giving tool and as such we are continuing to promote the fundraising opportunities life insurance provides and to include

comprehensive information regarding this potential method of giving in all of our education offerings. CAGP will continue to monitor the matter and provide further clarification or information as it becomes available.

2019

Gifts of Life Insurance & British Columbia’s Insurance Regulator [November 2019]

We wanted to provide our members with an update further to the alert shared in the November 7th CAGP eNews regarding the solicitation of gifts of life insurance, and recent enforcement action taken by the BC Financial Services Authority (BCFSA, formerly the Financial Institutions Commission, FICOM), the regulator of the Insurance Act in British Columbia. BCFSA has advised a charity in British Columbia that accepting donations of life insurance policies as donations from a BC resident is in contravention of the Insurance Act. The charity was directed to amend its website to specifically note that BC residents are not eligible to donate life insurance policies. This action appears to relate only to the actual donation of the policy – not to situations where a donor has designated a charity as a beneficiary under a policy.

CAGP’s Government Relations Committee discussed this matter at its meeting this week. Efforts are underway to communicate further with BCFSA in order to gain greater clarity as to its interpretation of the Insurance Act and its position on the matter. We will continue to monitor the situation. We are also monitoring discussions underway by other associations whose members have an interest in the situation, such as the Canadian Bar Association and the Conference for Advanced Life Underwriters, as well the emergence of any similar action by insurance regulators in other provincial jurisdictions.

The GR Committee cannot advise members on a specific course of action on this issue, but does want to bring it to your attention. Those charities who receive insurance policies on a regular basis may wish to contact their advisors. For those members in British Columbia, we share this notice from Norton Rose Fulbright and their recommended steps for charities in that province.

We know this is an issue of significant importance for charities and for CAGP members and, as we know that gifts of life insurance are an important planned giving tool, CAGP shares your concern. We are committed to staying apprised and keeping you informed.

Members are invited to reach out to our President & CEO, Ruth MacKenzie at rmackenzie@cagp-acpdp.org or 613.232.7991/888.430.9494 x223 with any questions, concerns or additional information.

CAGP Government Relations Update [October 2019]

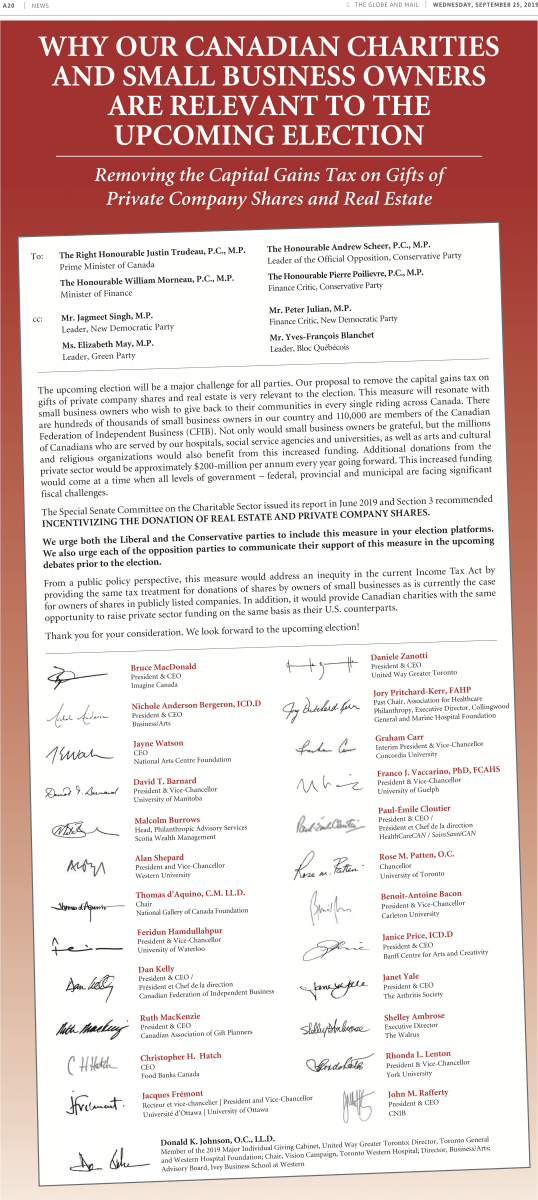

Full page advocacy letters were published on September 25th, 2019 in 13 newspapers across Canada, signed by charities located in each province. Letters signed by national umbrella organizations, including CAGP, were published in the Globe and Mail, the National Post and the Ottawa Hill Times. Attached are PDFs of the letters published in the Globe and Mail and the Toronto Star. A total of 156 charities signed these letters across the country.

Each organisation who signed has asked key staff and all of their board members to meet in person with their local M.P. and explain why this measure would benefit the people in their constituency who depend on the vital services provided by their charity. Raising awareness of this issue with all M.P.s across Canada will increase the chances of all parties including this measure in their election platforms.

2018

-

CAGP Government Relations Update [September 2018 eNews]

Despite the Government’s summer recess, CAGP was active with its government relations activities. In June, CAGP wrote to Senator Terry Mercer, Chair of the Special Senate Committee on the Charitable Sector to convey CAGP’s support and offer assistance in their information gathering and deliberations. In August, in response to its 2019 pre-Budget consultations, CAGP made this submission to the Federal Government’s Standing Committee on Finance. Finally, on Monday, September 17th, CAGP’s President & CEO, Ruth MacKenzie, was invited to speak to the Special Senate Committee on the Charitable Sector. Ruth appeared along with Donald K. Johnson and Adam Aptowitzer to discuss funding of the charitable sector, with a specific focus on the tax benefits as well as donating private company shares and real estate. We are pleased to share Ruth’s speaking notes.

2017

-

CAGP Writes to the Finance Minister [October 19 eNews]

Despite the Government’s summer recess, CAGP was active with its government relations activities. In June, CAGP wrote to Senator Terry Mercer, Chair of the Special Senate Committee on the Charitable Sector to convey CAGP’s support and offer assistance in their information gathering and deliberations. In August, in response to its 2019 pre-Budget consultations, CAGP made this submission to the Federal Government’s Standing Committee on Finance. Finally, on Monday, September 17th, CAGP’s President & CEO, Ruth MacKenzie, was invited to speak to the Special Senate Committee on the Charitable Sector. Ruth appeared along with Donald K. Johnson and Adam Aptowitzer to discuss funding of the charitable sector, with a specific focus on the tax benefits as well as donating private company shares and real estate. We are pleased to share Ruth’s speaking notes., we’re sharing the letter that CAGP Board Chair, Amanda Stacey and Government Relations Committee Chair Grant Monck wrote to Finance Minister Morneau regarding proposed tax changes related to private corporations. The letter strongly encourages the Government to consider the possible affects these changes may have on charitable giving and thus on Canada’s vital charities. Offering CAGP as a resource on tax policy and charitable giving with a view to the charitable sector has been positively received by Government in the past. Again, we would be pleased to hear from any members with specific instances where donors or clients are expressing concern as to how their own giving might be impacted by these legislative changes. Contact Ruth MacKenzie, CAGP President & CEO at rmackenzie@cagp-acpdp.org. -

Charities Day on the Hill [October 19 eNews]

October 17th was the 3rd Day on the Hill where a collective of Canadian charities convened for a dawn to dusk day of meetings with Senators and MPs from all parties. The core purpose of the annual Hill Day is to raise awareness about the sector and its breadth and impact, and the importance of a positive partnership between the Federal Government and Canada’s vital charities. The event, which included over 40 charity leaders attending over 50 meetings, was organized by Imagine Canada. CAGP was represented by President & CEO Ruth MacKenzie, and Vice Chair of the Board, Michelle Osborne. CAGP Board member Darren Pries-Klassen was also in attendance on behalf of Abundance Canada. Beyond the overarching goals for the day, key “asks” of Government included a commitment to collect and disseminate economic data about the sector, support for social innovation and social enterprise, legal and regulatory reform for rules governing charities and those related to political activity, as well as support for efforts to strike a Special Senate Committee to study the charitable and nonprofit sector. While, not surprisingly, there were no specific commitments from the day, most meetings were very positive with a few sector champions being identified. Imagine Canada will be kept busy in the coming weeks with a multitude of follow up communications. CAGP was thrilled to be involved and we thank Imagine Canada for their leadership and hard work to make this important collaborative initiative happen.

-

Tax Planning Using Private Corporations [October 5 eNews]

In July, the Finance Minister announced the government’s next steps to improve fairness in the tax system with changes the rules related to tax planning using private corporations. Many CAGP members have told us that are concerned by these proposed measures, feeling that it has the potential to negatively impact charitable giving. CAGP will be responding to the Department of Finance’s open call for input through a consultation process, to urge the government to ensure they give thoughtful consideration to any unintended consequences that this new tax system may have on vital donations to Canada’s charities. We will include the letter in the next issue of the CAGP eNews. In the meantime, should any members have practical examples of how charitable giving could be impacted, please send them to our President & CEO, Ruth MacKenzie at rmackenzie@cagp-acpdp.org. -

Further Advocacy on Gifts of Real Estate & Private Co Shares [October 5 eNews]

The impassioned Donald K. Johnson continues his advocacy efforts to legislate an exemption on capital gains tax for charitable gifts that result from the sale of private company shares and real-estate. He made his case to have this reconsidered as part of the 2017 fall fiscal update in this Open Letter to the Prime Minister and the Finance Minister, and we’re pleased to share the following articles by Mr. Johnson highlighting this issue:Policy Magazine – A Golden Opportunity to Help Canada’s Charities

Zoomer Magazine – A Capital Idea

Adam Aptowitzer presents a slightly different approach in this brief to the C.D. Howe Institute.

Mr. Johnson encourages CAGP members to meet with their local MP to educate them on the benefit that this measure would have for additional funding to charities in their communities. - Government Relations Committee - review of 2016, January 23, 2017

2016

- 2014 Federal Budget provisions regarding estate donation rules had unintended consequences for gifts of private company shares. On October 19th, as a result of active discussions CAGP’s GR Committee has had with the Department of Finance over the last year, a Notice of Ways and Means issued by the Department addressed those consequences through an amendment to the rules of non-qualifying securities. Malcolm Burrows explains the rules and the amendments in this special blog post.

- Day on the Hill Ask, October 18, 2016.

- On September 20th, a full-page letter to Prime Minister, Justin Trudeau, and Finance Minister, Bill Morneau, was published in the Globe & Mail and the National Post, asking the government to reconsider their decision this spring and proceed with legislation regarding the removal of capital gains tax on charitable gifts made from the sale of private company shares and real estate. This letter, made possible by the generous support of Mr. Don Johnson, was signed by leaders from 24 of Canada’s charities and nonprofits, among them, CAGP President & CEO, Ruth MacKenzie. Click here to read the letter.

- Submission to the House of Commons Standing Committee on Finance: Priorities for the 2017 Federal Budget, August 5, 2016

2015

- Canadian Donor’s Guide in the Hands of Canada’s Leaders, November 18, 2015

- CAGP letter to Department of Finance regarding new estate rules, September 2015

- Federal Platform Proposal: Stronger Together: Forging a New Relationship between Canada’s Charities and the Federal Government, July, 2015

- CAGP letter to Department of Finance regarding new estate rules, March 2015