Languages

Webinar Viewing: Unusual Gifts Exempt from Capital Gains

Unusual Gifts Exempt from Capital Gains

Every gift planner knows that donations of public securities are exempt from capital gains, but there are other assets that also get this treatment that are rarely considered. Malcolm will discuss the other capital gains exempt donations such as employee stock options, restricted stock, exchangeable shares, cultural property and ecogifts. Focus will be placed on the practical issues associated with identifying opportunities and the mechanics related to these donations.

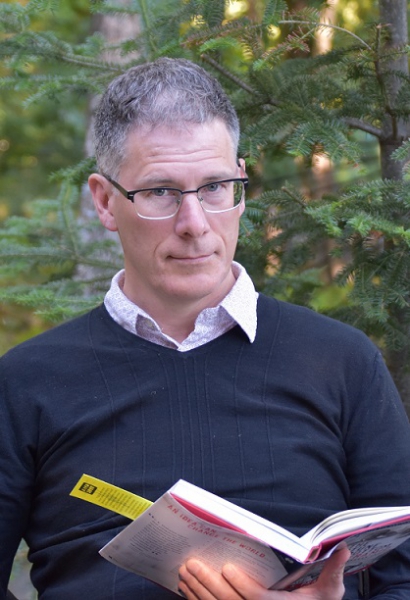

Malcolm Burrows

Malcolm Burrows is Head, Philanthropic Advisory Services at Scotia Wealth Management. He has 27 years of experience as a gift planner and philanthropic advisor and is the founder of Aqueduct Foundation, a public foundation with donor advised funds. He has been a friend of CAGP since 2004.

Malcolm Burrows is Head, Philanthropic Advisory Services at Scotia Wealth Management. He has 27 years of experience as a gift planner and philanthropic advisor and is the founder of Aqueduct Foundation, a public foundation with donor advised funds. He has been a friend of CAGP since 2004.

This session is a Webinar Viewing. Bring your own lunch, listen to a professional gift planner or advisor share their expertise through a live webinar, and network with your colleagues for only $10.

CAGP Waterloo-Wellington is a CFRE Continuing Education Approved Provider. Full participation in a Lunch & Learn or Webinar Viewing is applicable for 1 credit in Category 1.B – Education of the CFRE International application for initial certification and/or recertification.

CAGP Waterloo-Wellington is a CFRE Continuing Education Approved Provider. Full participation in a Lunch & Learn or Webinar Viewing is applicable for 1 credit in Category 1.B – Education of the CFRE International application for initial certification and/or recertification.

Cambridge, ON N3H 5K4

Canada

| Ticket | $ 10.00 + $ 0.00 Tax |